The Power of the Community Reinvestment Act: Strategies for Success

Explore opportunities to use the Community Reinvestment Act (CRA) to bring financial institutions, community development, and disability communities to together to promote successful employment and economic outcomes for people with disabilities and others with low- and moderate-incomes (LMI).

ON TOPIC

The Community Reinvestment Act and How It Benefits Low- and Moderate-Income Communities

Passed in 1977, the CRA encourages equal access to credit and financial services for the entire community, with an emphasis on LMI by engaging in community and workforce development activities. For example, bank employees develop financial services career pathways and conduct financial education for their local LMI community. These activities are a win-win by both serving the needs of the community and increasing the bank’s clientele and workforce. It is important that all CRA activities include people with disabilities to ensure the entire LMI community is served.

In this newsletter issue, you will learn about several resources for utilizing the CRA, including:

- A webpage to inspire CRA ideas

- An overview of last year’s CRA pilot projects

- CRA pilot success stories

- Webinars and other resources on utilizing the CRA

National Disability Institute’s (NDI) Center for Disability-Inclusive Community Development (CDICD)

NDI’s CDICD works to improve the financial health and well-being of LMI individuals with disabilities and their families by increasing awareness and usage of the opportunities and resources available under the CRA.

This webpage contains webinars, podcasts, and tools that promote CRA opportunities.

Five target audiences: The CDICD website has a wide range of materials to support:

- Financial Institutions,

- LMI Persons with Disabilities,

- Community-Based Organizations Serving LMI Persons with Disabilities and Their Families,

- Community-Based Organizations Serving LMI Populations Generally, and

- Financial Institution Regulators.

Inclusive Community Development Awards: The CDICD webpage also includes Inclusive Community Development Awards to spotlight those doing particularly well in this space and to inspire others.

ON THE GROUND

CRA Pilots

In 2021, the LEAD Center initiated three pilots using the CRA as a starting point. These pilots, based in Albany, New York; Broward County, Florida; and Kalamazoo, Michigan, create partnerships with banks to develop financial education and financial industry career pathways services in the workforce system, focusing on LMI individuals from traditionally underserved communities. These pilots adopt best practices for Diversity, Equity, Inclusion, and Accessibility (DEIA) to connect diverse communities, including people with disabilities, to financial empowerment resources and career pathways with living wages.

These three pilots, highlighted below, successfully weave together a team of banks and financial institutions, organizations serving communities of color, and the workforce system (e.g., American Job Centers, Workforce Development Boards). While banks stand to gain CRA credits, individuals stand to gain skills support and new livelihood options. These pilots focus on the idea that banks can open doors to financial services careers in partnership with the workforce system their funding supports. The pilot leadership teams work with bank staff to structure customized career pathways for jobseekers in the community who are interested in working at local banks. For instance, career pathways are created for people to set their sights on an analyst position and steadily move up the career ladder from entry-level positions with less pay, benefits, and flexibility. Both banks and LMI individuals have benefited as a result.

Success Stories: New York, Florida, Michigan

The New York pilot in the Capital Region aimed to create a career pathway in the financial services industry. They engaged people from LMI communities and enhanced current credit repair services to make them available to all customers. Ultimately, the Capital Region developed a strong leadership team and expanded through partnerships with education leaders and connections with bank regulators. They established relationships with four banks/credit unions with whom they are developing customized career pathway/ladder models. They conducted resource mapping on financial capability services and began to shift leadership focus primarily to career pathways. They worked with CDICD and the United Way to hold a summit for banks and workforce system staff to discuss opportunities to partner around CRA credit.

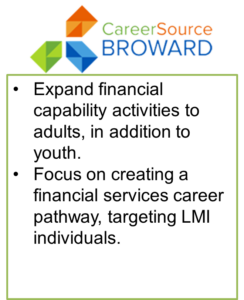

The Florida pilot, CareerSource Broward, aimed to expand financial capability activities to adults and youth while also, creating a financial services career pathway to target individuals from LMI communities. CareerSource Broward successfully established financial capability training for jobseekers in the LMI community. They completed a map of financial capability services and resources in Broward County. They also developed a financial capability services desk aid for use by career service professionals and the people they serve. To ensure continued success, they created relationships with Florida-based regulators from Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC) to provide leadership strategies with CareerSource Broward’s outreach to banks and continued support with future interactions with banks.

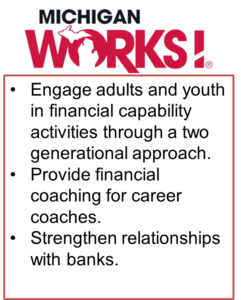

The Michigan pilot, MichiganWorks! Southwest, aimed to engage adults and youth in financial capability activities through a two-generational approach; provide financial coaching for career coaches; and strengthen relationships with banks. They also organized and hosted a financial wellness panel across four counties.

Though there were many successes and lessons learned so far, these pilots are only the beginning. In the future, the LEAD Center plans to host high-level meetings between the U.S. Department of Labor and federal level bank regulators (FDIC, OCC, and Federal Reserve Board) to encourage promotion of workforce-bank collaboration and intersectional disability inclusion nationally. Through the CRA pilot, the LEAD Center team learned banks and local workforce boards share an interest in supporting living-wage jobs and career opportunities for LMI individuals, including people with disabilities. The LEAD Center will apply the learnings to launch a second phase of the CRA pilot to scale efforts to further support inclusive career pathways in the financial services industry.

ON CUE

Resource: Workforce Systems Can Leverage Bank Resources to Improve Economic Self-Sufficiency and Employment Outcomes for Low- and Moderate-Income Individuals (LEAD Center) — This resource explains how workforce systems can leverage bank resources to improve economic self-sufficiency and employment outcomes for LMI individuals.

Resource: Engaging Workforce Development: A Framework for Meeting CRA Obligations (Federal Reserve Bank of Kansas City) — This resource provides information to banks and organizations interested in partnering around how the CRA can be leveraged to support workforce development goals.

Resource: Webinar Archive: Workforce and Bank Partnerships: Tales of Three Workforce Boards (LEAD Center) — This webinar outlines strategies to build connections between workforce boards and banks, as well as strategies to leverage bank resources.

Conference Presentation

Innovative Strategies to Empower Youth with Intersecting Identities (November 2022)

This workshop shares promising practices for developing inclusive learning environments for youth. By acknowledging and supporting youth’s intersecting identities (e.g., a youth could identify as lesbian, Latina, and having a learning disability), we can honor and value all aspects of their identities and meet their unique strengths and needs.

Webinars

A Roadmap to Inclusive Career Pathways: Promoting DEIA Through Cross-System Partnerships (February 2, 2023)

This webinar discusses resources to create inclusive career pathways and explains how the District of Columbia has successfully broadened its reach into underserved communities. In addition to sharing valuable resources on an interactive online Roadmap to Inclusive Career Pathways, panelists share their strategies, experiences, and resources to support inclusive career pathways; create partnerships across government agencies and with underserved communities to promote DEIA; and enable people with disabilities to succeed in the workforce.

ON THE HORIZON

Workforce System and Bank Partnerships: A “How To” Guide (May 2023)