Building Credit and Community: A Look Inside Louisville’s LABS Pilot Program

Since 2014, LADDER (Louisville Alliance for Development through Diversity Empowerment and Resources) supports opportunities to integrate financial empowerment in workforce development systems to insure the inclusivity of persons with disabilities in accessing empowerment opportunties, and seeks to establish a community-wide culture of inclusiveness.

Data makes it abundantly clear that individuals with disabilities face significantly more barriers than other members of the population when it comes to financial stability and equality. In fact, households with members with a disability are twice as likely as households without a disability to have incomes below the federal poverty line (2016 American Community Survey). Furthermore, individuals with disabilities are also twice as likely to be unemployed compared to their able-bodied counterparts in the same demographic range (2016 American Community Survey). The lack of employment prospects and low wages that have become the norm for those living with disabilities makes every day financial challenges an incredibly difficult task. With lower incomes and lower employment opportunities for individuals with disabilities, millions of Americans with disabilities are stuck in a cycle of poverty.

The 2018 Scorecard released by Prosperity Now reports some stunning state-level data: 26.7 percent of all Kentucky households with a member with a disability live below the federal poverty threshold; and 52.8 percent of all Kentucky households with adults with disabilities live in liquid asset poverty, meaning that more than half of households with adults with disabilities do not have enough money to weather a significant emergency. These statistics clearly identify a need. In effort to address these challenges, LADDER developed and launched a pilot program to address the asset building challenges associated with Louisville residents with disabilities.

The 2018 Scorecard released by Prosperity Now reports some stunning state-level data: 26.7 percent of all Kentucky households with a member with a disability live below the federal poverty threshold; and 52.8 percent of all Kentucky households with adults with disabilities live in liquid asset poverty, meaning that more than half of households with adults with disabilities do not have enough money to weather a significant emergency. These statistics clearly identify a need. In effort to address these challenges, LADDER developed and launched a pilot program to address the asset building challenges associated with Louisville residents with disabilities.

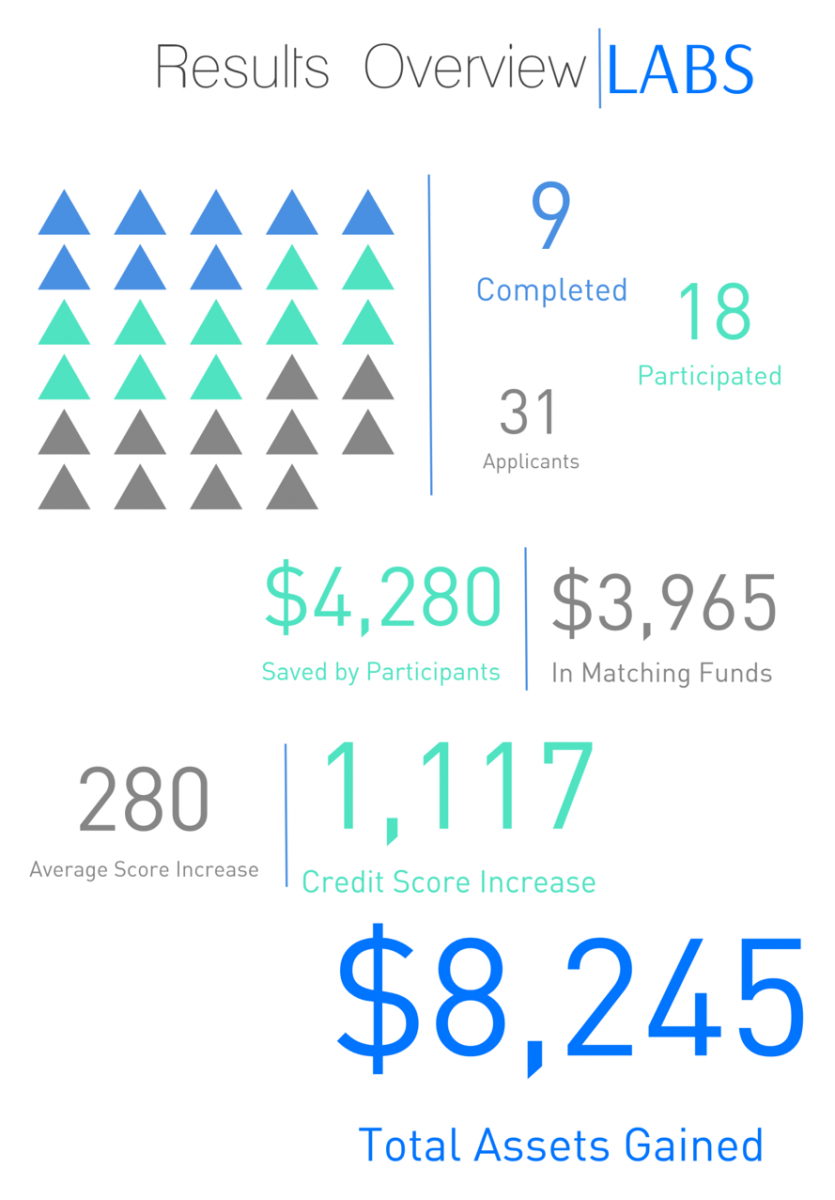

In 2016, LADDER, through Louisville Metro Office of Resilience and Community Services along with agency partners Goodwill Industries, Center for Accessible Living and the Office of Vocational Rehabilitation, implemented a pilot program, LABS (LADDER Asset Building Strategies), designed to increase the overall financial well-being of individuals with disabilities through small dollar loan and matched savings opportunities. Participants could borrow up to $500 with 0 percent interest through the small dollar loan opportunity, and matched savings participants could earn a 1:1 match for every dollar saved – up to $500. Through peer mentorship, and help from their case managers, participants were encouraged to establish consistent savings habits, build their credit, and attain short-term financial goals.

Participants had the chance to take part in one or both opportunities – the small dollar loan and/or the matched savings. In order to maximize the impact of LABS, several strategies (peer mentorship, case management, credit health education, financial coaching and access to financial planning software) were included in the program. Peer mentorship and direct agency involvement provided oversight and support for LABS. Peer mentors encouraged participants to establish consistent savings habits, stay on track, make repayments on time, and motivated participants to focus on their short-term financial goals; case managers helped organize and support participants.

Overall, nine participants successfully made progress or completely achieved their short-term financial goal. Matched savings participants saved a total of $4,280.62 and, with the match incentives, total savings were $8,246.24. Nearly 67 percent of matched savings participants met or exceeded their savings goals. Loan borrowers increased their credit scores by an average of 280 points. Four out of five loan borrowers, or 80 percent, increased their personal credit scores.

These results represent more than dollars saved and points on a credit score. A report by Prosperity Now highlights the impact and influence asset-building opportunities, like LABS, can make on behavioral change with participants. According to the report, savings programs helped participants develop savings patterns that “increased [habit strength] over time during program participation and savings habits reduced the stress of financially difficult situations.” These results represent concrete changes – actual savings to help weather the next emergency or plans for the future; and access to opportunities for more and affordable credit, etc. Asset-building efforts like LABS truly create opportunities for financial security and financial equality and allow individuals to take control of their financial lives and futures.

Kyle Durbin is currently an Intern for the Office of Financial Empowerment at Louisville Metro Government’s Office of Resilience and Community Services in Louisville, KY. The Office of Financial Empowerment focuses on the unique opportunities and challenges of low-income and economically vulnerable citizens. In this capacity he is responsible for executing a range of projects including data analysis, producing marketing materials and general staff support. Earlier in his career Durbin has worked as a Reporter Intern at Louisville’s NPR Affiliate WFPL, a Tax Payment processor at an IRS Lockbox and presently is the Co-owner and Operations Manager of a media marketing company XPLouisville. He holds two bachelor degrees from the University of Kentucky in International Studies and Gender and Women Studies. He enjoys long walks on the beach, his favorite color is clear and he likes the smell of water.

Kyle Durbin is currently an Intern for the Office of Financial Empowerment at Louisville Metro Government’s Office of Resilience and Community Services in Louisville, KY. The Office of Financial Empowerment focuses on the unique opportunities and challenges of low-income and economically vulnerable citizens. In this capacity he is responsible for executing a range of projects including data analysis, producing marketing materials and general staff support. Earlier in his career Durbin has worked as a Reporter Intern at Louisville’s NPR Affiliate WFPL, a Tax Payment processor at an IRS Lockbox and presently is the Co-owner and Operations Manager of a media marketing company XPLouisville. He holds two bachelor degrees from the University of Kentucky in International Studies and Gender and Women Studies. He enjoys long walks on the beach, his favorite color is clear and he likes the smell of water.